Below translated via DeepL and a few homo sap tweaks, an article on financial security from the online crowd-sourced MBA Knowledge Base Encyclopedia MBA智库百科 . The section of the article on Issues of Financial Security for China I have placed first. The full text comes after that excerpt.

Google Translate can help sino-illiterates explore some of the Chinese perspectives in this online encyclopedia. Here is the Google Translate URL for an English translation for MBA Knowledge Base Encyclopedia.

Many won’t find anything startling in this article yet it is handy to see it all laid out from Chinese perspectives.

As someone who started studying Chinese in the mid 1970s, I am always amazed at how similar the presentation is to the thinking of economist in the West. Very different from Mao’s time of dramatic leaps forward, we live in the same world now.

Financial stability, one of the props for overall social stability is always a top concern for the Chinese Communist Party and the PRC state as of course it is for other countries. The PRC seems to prefer static stability compared with Western economies which one may say are dynamically stable. This reminds me of Chengdu writer Ran Yunfei’s 2010 article Pathological Stability is the Root of Social Instability [变态维稳是社会不稳定的根源] available elsewhere on this translation blog.

As the article below points out, among the reasons for this are the concern about an uncertain international environment as the Chinese economy opened after its WTO entry and an immature financial regulatory system.

Another reason is the Chinese Communist Party is a totalitarian governing Party [see Is China Totalitarian or Authoritarian?] determined to manage every aspect of society — control freakery is commonplace along with officials using their powers to extract corrupt rents. But that is another story.

Issues of Financial Security for China

from MBA Knowledge Base Encyclopedia

我国金融安全的问题

At present, the situation of financial security for China is still not optimistic, mainly in the following aspects:

1. The negative impact of illegal capital flows on the financial security of the country.

Openness to the outside world has facilitated the development of China’s economic and financial internationalization, and the increase in the degree of external dependence indicates that the level of China’s utilization of international resources and the international market has greatly improved, and that China’s ability to participate in the international division of labor and international competition has been further strengthened, which has played an extremely important role in raising the overall level of China’s national economy.

However, as a developing country, in the process of opening up to the outside world, there are many factors that have caused serious negative impacts on the financial security of our country, and an important manifestation of these factors is the illegal inflow and outflow of capital. This has adversely affected the normal financial order of China, increased the difficulty of macro-financial regulation and control, reduced the effectiveness of monetary policy, and easily caused financial bubbles and increased financial risks.

2. The risks posed by economic globalization to China’s financial security.

Under the trend of economic globalization, the outdated operation mode of traditional financial enterprises in China is obviously at a disadvantage in the competition with advanced financial operation modes abroad, and it is difficult for the existing macroeconomic regulation and control tools to meet the requirements of integrated economic development. Therefore, the opening up of China’s economy and finance to the outside world is a complex systematic project, which should be carried out in a gradual and orderly manner on the basis of vigorously improving the domestic macroeconomic and financial regulation and control capabilities.

3. Challenges to China’s financial security as a result of its accession to the World Trade Organization.

It is important to fully recognize the pressure and impact that the opening up of the financial market will have on China’s financial industry.

- First, the state-owned commercial banking system, which has yet to be fully corporatized, is unable to compete with large and powerful banks in developed countries in terms of service quality, work efficiency, operational capacity, and technological conditions, despite its large number of branches. Once foreign banks are allowed to enter the market in large quantities and the restrictions on Renminbi (RMB) business are lifted, the four major state-owned commercial banks will face a serious problem of loss of some of their high-quality customers.

- Second, under the conditions of financial liberalization, the market interest rate will inevitably replace the official interest rate, and the existing non-market-based exchange rate determination mechanism will be put to the test.

- Third, with the continuous liberalization of the money market, capital market and foreign exchange market, the free flow of capital will bring a lot of difficulties to China’s economy, financial macro-control and financial supervision, and the flow of large amounts of short-term capital in and out of the country will pose a great threat to China’s financial security.

4. The impact of capital account liberalization on China’s financial security.

After joining the World Trade Organization, China’s requirements on capital transfer limits will be relaxed, the control of foreign exchange receipts and expenditures of foreign enterprises belonging to capital items will be loosened, and the control of the amount of foreign exchange assets held by residents abroad will also be loosened, which will undoubtedly increase the difficulty of managing the capital account: once a large amount of long-term capital inflow occurs, the rapid increase of resources can’t be efficiently configured and utilized, plus the increase of banking system liquidity will stimulate the excessive increase of financial asset prices, which will in turn lead to the vulnerability of the whole financial system, or even collapse. This, coupled with the increase in liquidity in the banking system, will stimulate excessive increases in financial asset prices, which in turn will lead to economic bubbles and ultimately to the weakening or even collapse of the entire financial system.

5. The impact of international hot money on China’s financial security.

According to the estimates of the International Monetary Fund (IMF), the daily volume of international financial asset transactions is about 80 times the volume of trade transactions. At present, short-term capital of a lobbying nature has exceeded US$10 trillion, and US$1 trillion of lobbying capital seeks a home in the global capital market every day. In our country, since financial laws and regulations are not yet sound, and the security supervision capacity is not yet sufficient to cope with external risks, once a large amount of international liquidity impacts our financial market, it is bound to cause chaos in the financial order and trigger a financial panic.

6. Internet finance raises new issues for China’s financial security.

With the rapid development of global computer technology, online banking and finance have become a reality. On the Internet, banks and customers can complete their daily business transactions without having to meet in person, which eliminates time and geographical differences, changes the traditional mode of financial business operation, and improves service quality and efficiency. At the same time, however, it should also be noted that as an open Internet, its security is increasingly threatened by various aspects. In recent years, the online banking systems of many countries in the world have been attacked to varying degrees, and these facts clearly tell us that the more high-tech technology exists, the more there is the hidden worry of being disturbed or even paralyzed.

The Internet banking business in China is in its infancy, and the risk prevention measures are not yet perfect. Many important banking systems, such as the online banking payment system, credit card system, and clearing system, are at risk of being attacked and damaged by uninvited guests at any time. We have introduced advanced online financial technology, but the supporting risk prevention system and security alert system need to be gradually integrated with China’s national conditions, and in the meantime, the issue of financial security is particularly important.

7. The backwardness of financial equipment and the low degree of nationalization are major hidden dangers to China’s financial security.

- First, most of the platforms used by banks in China for financial e-business are imported from abroad and are fundamentally unsafe. We may focus too much on the benefits and convenience of e-business, but it is easy to overlook the fact that most of the e-business platforms we use are imported from overseas. Since the software of these platforms does not disclose the source code, there is no way to know the strength of their risk ,prevention capability.

- Second, most of the core technology of financial electronic equipment in China is imported from abroad, making the foundation of financial security extremely fragile. In the process of developing financial electronics in China, the idea of “exchanging market for technology” was put forward, just as in the process of introducing equipment in other industries. However, in the process of financial electronics, the dependence on foreign technology has been increasing, whether it is the operating platform within the entire financial system or core technologies such as electronic payment systems. As a result, the foundation of China’s financial security is extremely fragile. The reason for this consequence is that in the process of introducing financial equipment, it has always been the introduction of consumer behavior, usually directly by major banks and financial institutions, so they are concerned about consumer technology rather than research and development and equipment technology. As a result, we have not been able to support our own financial equipment research, development and production forces in the same way as the automobile manufacturing industry and other industries.

8. Financial supervision is not yet fully adapted to the needs of China’s financial security.

Judging from the actual situation of China’s economic and financial internationalization, the capacity of China’s financial supervision is not yet fully able to meet the needs of external opening. There is still a gap between the organization of financial supervision, human resources and technical means and the requirements of modern financial supervision. The financial supervisory system and level of supervision are not yet fully adapted to the needs of China’s financial security.

9. The construction of the financial legal system is not fully compatible with the requirements for safeguarding China’s financial security.

Financial laws and regulations are the legal basis for the implementation of financial supervision and the protection of financial security in China, and are also the fundamental guarantee for the standardization and legalization of financial supervision. In recent years, China has promulgated a series of financial laws, such as the Law of the People’s Bank of China, the Commercial Bank Law, the Insurance Law, and the Securities Law, which have played a positive role in practice. However, China’s financial legislation is still a very difficult task, and certain aspects of the legislation are obviously lagging behind, which is not yet in line with China’s financial reform and the requirements for safeguarding financial security. From the financial practices of various countries, with the global financial liberalization, internationalization, integration as the characteristics of the continuous development of financial change, countries in the financial legislation, in particular, pay more attention to control, supervision and grasp of the scale.

In the course of development, some emerging countries in Asia have failed to realize the importance of effective supervision based on the liberalization of interest rates and opening up of domestic financial markets through legal means and forces, thus the entire national economy lacks the necessary ” firewall ” and serious deficiencies in the financial legal system, especially in the regulatory laws and regulations, which were fully exposed when they were hit by the shock and became a source of concern for the international financial community. These deficiencies were fully exposed when the country was hit, and became the mechanism that led to the entire financial crisis. In the course of its development, China must face this problem squarely and vigorously strengthen its financial legislation in order to realize effective financial supervision, circumvent institutional risks and safeguard financial security.

Financial Security

MBA 智库百科 金融安全

Overview of financial security

Financial security refers to the safety of monetary and financial communications and the stability of the entire financial system. Financial security is a fundamental issue in the study of financial economics, and nowadays, with the accelerated development of economic globalization, the status and role of financial security in national economic security are increasingly strengthened. Financial security is closely linked with financial risks and crises, and the degree of security can be explained and measured by risks and crises, and the degree of risks and crises can also be explained and measured by security. The higher the degree of security, the lower the risk; conversely, the higher the risk, the lower the degree of security; crisis is the result of a large-scale accumulation and outbreak of risk, and crisis is a serious insecurity, which is an extreme of financial security.

As the lifeblood of the entire economy and society, financial security and stability have a direct impact on the overall development of China’s economy and society. If financial security is lost, it is very likely to cause social unrest. On the other hand, financial security must be built on the basis of social stability, because certain unexpected factors of social instability are often the triggers of financial crises.

According to the nature of financial business, financial security can be categorized into banking security, currency security, stock market security, etc., and the extremes of which are banking crises, currency crises and stock market crises.

The Connotation of Financial Security

In order to accurately understand the concept of financial security, it is necessary to further explore the correlation and important distinction between financial security and financial risks and financial crises.

1. Financial Risk and Financial Security

Financial risk is closely linked to financial security, but there are important differences. Financial risk refers to the risk of loss that a financial institution may incur in the course of conducting financial transactions. Financial risk usually includes: credit risk, market risk, country risk. Financial risk is the possibility that the result of financial behavior deviates from the expected result, and the uncertainty of financial results. The essential meaning of financial risk is the possibility of loss and profit of financial assets. This possibility accompanies all financial activities. As long as there are capital trading activities in the banking sector, financing and changes in asset prices in the securities market, and insurance business, or as long as there are financial activities, there is bound to be financial risk. Obviously, the existence of financial risk is a normal condition of economic operation.

Financial risk and financial security are closely related, the generation of financial risk constitutes a threat to financial security, the accumulation and outbreak of financial risk causes damage to financial security, and the prevention of financial risk is the maintenance of financial security. However, financial risk and financial security are different from each other. Financial risk is mainly from the perspective of the uncertainty of financial results to explore the risk of generating and preventing problems, financial security is mainly from the perspective of maintaining the normal operation and development of the financial system to explore the threats and attacks from where and how to eliminate them. Some domestic scholars believe that financial security is the state of no financial risk, in fact, financial risk does not necessarily lead to financial insecurity. In fact, financial risk does not necessarily lead to financial insecurity. The reality is that if financial risk is well controlled and well organized, then there is a state of financial security in the midst of extensive financial risk. Financial insecurity is not equal to financial risk. Because financial risk is accompanied by financial activities. As long as you engage in financial activities, there is financial risk. It is rooted in the differences in time and space that are inherent in financial activities. Therefore, financial risk does not mean financial insecurity.

Generally speaking, in international economic activities, the size of the financial risk and the country’s degree of external dependence is positively proportional to the change, that is, the lower the degree of external dependence, the smaller the risk faced by the country; on the contrary, the higher the degree of external dependence, the greater the risk faced by the country, this is the process of internationalization of the economy the development of the objective law, is not subject to the will of the people as a shift. However, since the concept of financial security is relative, the ability of a country to resist risks and infringements can only be used as a standard to measure the degree of financial security, which means that the size of financial risks and the degree of financial security depend on the country’s ability to prevent and control risks, i.e., if the ability to prevent and control risks is stronger, the risks faced by the country will be smaller, and the degree of financial security will be higher; on the contrary, if the ability to prevent and control risks is stronger, the country will face smaller risks and the degree of financial security will be higher; on the other hand, if the ability to prevent and control risks is stronger, the risk will be higher. On the other hand, the weaker the ability to prevent and control risks, the greater the risks faced by the country and the lower the degree of financial security. Obviously, when a country’s degree of external dependence increases, and when it gains numerous benefits from it and promotes its economic development, it also implies an increase in its responsibility and pressure to guard against financial risks, withstand external shocks, and safeguard financial security.

2. Financial Crisis and Financial Security

Financial crisis refers to the chaos and turbulence in the financial system and the financial system. The main manifestations are: compulsory liquidation of old debts; drastic reduction of commercial credit; stagnation of bank funds, massive withdrawal of cash by depositors, and closure of some financial institutions; downturn in the market for marketable securities and a sharp decline in the issuance of such securities; severe currency starvation, lack of borrowing funds, and sharp increase in market interest rates, which led to turbulence in the financial market; and decline in the value of the local currency.

A financial crisis is a crisis that occurs in the monetary and credit fields. In Western economics, there are many definitions of financial crisis, but the most representative one is the definition of financial crisis in the famous New Palgrave Dictionary of Economics: “A sharp, short-term, and super-cyclical deterioration of all or most financial indicators – short-term interest rates, asset (securities, real estate, land) prices, business bankruptcies, and the number of failures of financial institutions. ” Financial crises are characterized by massive selling of real estate or long-term financial assets in anticipation of a fall in asset prices in exchange for money. This is the opposite of a financial boom or a financial distress, which is characterized by a massive sell-off of money in anticipation of an increase in asset prices and the purchase of real estate or long-term financial assets. Financial crises can include specific financial crises such as currency crises, debt crises, financial market crises and banking crises.

Marx believed that financial crises were mostly signs of economic crises and that financial panic was the initial stage of an economic crisis. The root cause of financial crises lies in the system, that is, the contradiction between the social nature of production and the private ownership of capitalists. When this basic contradiction of capitalism reaches an irreconcilable point, it will be temporarily and forcibly resolved in the form of an outbreak of a crisis, which will cause enormous damage to the productive capacity of society. Credit, money and finance are but one of the links in the chain.

Marx pointed out in Das Kapital: “At first sight, it seems as if the whole crisis was characterized only by a credit crisis and a currency crisis. And, in fact, the question is only whether bills of exchange can be converted into money. But the fact that such bills of exchange mostly represent real purchases and sales, and that such real purchases and sales expand far beyond the limits of social needs, is in the final analysis the basis of the whole crisis.” “If the system of credit manifests itself as the main lever of overproduction and excessive commercial speculation, it is only because the process of regeneration, which by its very nature can be stretched, is here reinforced to its limits” and “credit accelerates the violent outburst of this contradiction, that is to say, the crisis”. The crisis”.

Of course, Marx did not deny the existence of independent financial crises, because money and credit financial activities have a certain degree of independence from productive activities. Crisis can be caused by excessive expansion of credit, rapid development of banking and increased speculation. Thus monetary crises can occur independently, and the financial sector has its own crises.

The opposite of financial security is financial insecurity, but it is by no means the outbreak of a financial crisis. Some scholars in China describe the essence of financial security as the financial risk situation, while financial insecurity is mainly characterized by financial risks and financial crises. In fact, a financial crisis refers to a country’s financial sector that has experienced a serious chaos and turbulence, and in fact, the country’s banking system, money and financial markets, foreign trade, balance of payments and even the entire national economy has caused a catastrophic impact. It often includes national debt crises, currency crises and financial institution crises. This shows that financial crises are the result of the accumulation of financial insecurity, which is the result of financial risk.

3. Financial security is the security of dynamic development.

There is no absolute safety in the world, and safety is relative to danger. For example, for some international financial centers with good market fundamentals, institutionalized financial systems, standardized legal environments and effective supervision, no one is worried that the innovation of financial instruments will put banks in an insecure state; whereas for domestic commercial banks with a high proportion of non-performing assets and a high degree of vulnerability, the possibility of financial risks brought about by new financial instruments is relatively high. Therefore, financial security should be the state of ability to cope with the ever-changing international and domestic financial environment.

Financial security should be a dynamic state of security. This is because the state of economic operation is a continuous process of change, and in this process, financial operation is often in a continuous pressure and inertia. In a period of rapid economic growth, banks will continue to expand credit, the result of which may lead to an increase in non-performing assets; in a period of economic recession, the deterioration of the operating environment of the bank forced it to contract credit, which in turn led to further economic recession. This situation can be explained by the long wave of financial system vulnerability in modern financial crisis theory. Therefore, financial security is a dynamic equilibrium based on perfect and symmetric information and the good operation of its feedback mechanism, and the acquisition of a state of security is realized through continuous adjustment.

Financial security is financial stability in a specific sense. Since financial security is a state of dynamic equilibrium, this state is often manifested in the development of financial stability. However, financial stability and financial security are still different in content: financial stability focuses on the stable development of finance, without major financial turbulence, emphasizing the concept of static; while financial security focuses on emphasizing a dynamic state of financial development, including the dynamic adaptation to changes in the macroeconomic system and economic restructuring. When studying the problems related to financial crises, foreign scholars apply the concept of financial stability more often and use the concept of financial security less often.

4. Financial security issues as a product of financial globalization

The issue of financial security is a product of a specific stage of historical development, a product of financial globalization and, more precisely, a product of the negative impact of financial globalization. Despite the positive effects of financial globalization in promoting the development of the world economy, it cannot be denied that financial globalization has also brought about many negative effects, and financial globalization carries the risk of triggering financial crises. In the course of the development of financial globalization, its accompanying contagion effect has led to the rapid spread of financial crises, generating huge ripple and magnification effects, and international financial turmoil has become a norm. Therefore, the issue of financial security has been raised as an important strategy for coping with financial globalization, and it has become an important component of national security strategy.

The basis for the existence of a state of financial security is the independence of economic sovereignty. If a country’s economic development is already subject to other countries or other economic entities, then no matter how fast it develops, it should be said that the hidden danger of financial security always exists, and there is no way to talk about the maintenance of financial security. Financial globalization has widened the gap between developed and developing countries. The development of financial globalization has made the international community pay more and more attention to the formulation and implementation of uniform standards. As developed countries have taken the lead in financial globalization, the rules formulated according to the level of developed countries will definitely be unfavorable to the developing countries, making it difficult for them to obtain the necessary development funds, thus further widening the gap between the developing countries and the developed countries. The objective reality of inequality in the international economy and finance has prompted some countries to pay attention to financial security.

Internal and external factors affecting financial security

1. Internal factors affecting financial security

The state of a country’s financial security, and the degree of its financial security, depends primarily on its ability to prevent and control financial risks and on market perceptions and attitudes. This objective ability and subjective perception and attitude are backed up by a variety of related resources for mitigating and managing risks. That is to say, the national differences in financial security issues make the ability and confidence to maintain financial security different from one country to another, and thus the factors affecting financial security also differ from one country to another. However, on the whole, a country’s ability to maintain its financial security is at least as much influenced by internal as by external factors.

Endogenous factors refer to the deterioration of the financial situation caused by the economy itself, including the real economy and the financial system itself.

First, the economic strength of a country. International experience shows that if a financial crisis occurs in a country, the authorities usually mobilize various resources to control the situation and get rid of the crisis. The resources that can be mobilized include administrative resources and economic resources. Administrative resources include mobilizing social forces and enlisting the support of the international community, but more importantly, economic resources, and a large amount of economic resources have to be mobilized for the bailout. Obviously, whether the bailout can be implemented smoothly and whether the lack of confidence can be remedied will depend on the economic strength of the country.

Secondly, the degree of perfection of the financial system. This can be understood from two aspects: first, whether the macroeconomic environment of the country is harmonized with the financial system, that is, whether there is a good macroeconomic environment for the normal operation of the financial system; second, the degree of perfection of the financial system’s own institutional environment, such as the status of the property rights system, the status of the governance structure, and the status of the internal control system of the financial institutions, and so on.

2. External factors affecting financial security

First, position in the international financial system. A country’s position in the international financial system greatly affects its ability to maintain financial security. For example, whether or not the country’s currency is the main international reserve currency, whether or not the country has the dominant power to set international financial rules. From the situation of the major developed countries in the West, they not only have quite a sound financial system, but also occupy a dominant position in the international financial system, and thus have extremely strong control and manipulation of both the domestic financial market and the international financial market, and the resources for maintaining financial security are extremely rich. In these developed countries, even if there is a problem with financial security, it usually does not extend into a global financial crisis, and the financial sector can still maintain stable development. Contrary to the situation of developed countries, developing countries are at a disadvantage in the international financial arena,they are unable to change or find it even difficult to influence the international financial market, and their low-developed internal financial markets and fragile financial systems are often controlled by financial capital from developed countries. Therefore, for most developing countries, if there is a problem with financial security, it will often jeopardize the stability of the financial system and the financial system, and may even jeopardize economic and social security.

Secondly, there is the impact of international capital flows. Shocks from outside a country’s economy, especially the impact of international capital flows, may become the direct cause of financial system insecurity. From the financial crises in recent years, international hot money usually takes the countries or regions that have obvious internal defects as its first target, especially those countries or regions that have excessive short-term foreign debts and the exchange rate of the local currency is seriously deviated from the actual exchange rate are often the first to bear the brunt. The usual tactic used by international hot money is to impact both the foreign exchange market and the capital market, causing sharp fluctuations in the market in the short term, so as to realize their speculative profits. Under the impact of international hot money, drastic fluctuations in the market will definitely affect the market expectations and investment confidence of investors, which may lead to market panic and massive capital flight, and as a result, the exchange rate and the prices of stocks will fall drastically across the board. In order to rescue the situation and defend the exchange rate of the local currency, the central bank often raises the interest rate to attract foreign capital, thereby further dampening domestic investment, worsening the economic situation and plunging the domestic economy into a vicious circle. The situation of some Southeast Asian countries in the Asian financial crisis is basically consistent with this process.

Financial Security Situation Monitoring and Early Warning

1. Judgment of the basic situation of financial operation

Financial security includes both the security of the financial system (e.g., the security of financial institutions, the security of financial assets, etc.) and the security of financial development. What financial security requires is a kind of macroeconomic security, and financial security is a state of dynamic development. As some scholars have pointed out, if a few financial institutions go bankrupt and close down in the competition, it is a generalization to consider financial insecurity; if a temporary financial difficulty arises at a certain point in time, it is also a trivialization to consider financial insecurity. From the point of view of financial operation, financial security is only one of the objective and subjective states. The antithesis of financial security is financial insecurity, the threshold between financial security and financial insecurity is the basic financial security, and financial crises are the result of the accumulation of financial insecurity, see Table 1.

| financial security | No significant risk | All risk indicators are within the safety zone, the financial market is stable, financial operations are orderly, financial supervision is effective and the financial sector is developing steadily. |

| Financial Basic Security | Slight Risk | Financial signals are basically normal, with some indicators close to the early warning values; non-performing assets are below 10% of total assets; there are normal financial institution failures, but the share is very small; there is pressure for currency depreciation; and financial operations are stable. |

| Financial insecurity | Serious Risk | Deterioration of most financial indicators; non-performing assets (NPAs) in most financial institutions to varying degrees, with NPAs accounting for more than 10% of total assets; more financial institutions failing; relatively large currency depreciation; financial turmoil and economic recession. |

| Financial crisis | Total Risk Explosion | It was the result of the accumulation of financial insecurity that led to the outbreak of a serious currency and banking crisis, with a sharp depreciation of the currency and the closure of a large number of financial institutions; financial collapse, economic regression and social unrest. |

The four basic states of financial operation were fully manifested in the Asian financial crisis that broke out in 1997: First, financial crisis, during which a financial crisis broke out in Indonesia and the financial turmoil spilled over into the political arena, leading to political turmoil, economic retrogression and social upheaval. Second, financial insecurity. The financial operation of Thailand, South Korea and Japan before the outbreak of the Asian financial crisis was typical of financial insecurity. Third, basic financial security. Although China faced the pressure of RMB depreciation during this period, its economic and financial conditions were basically good. Fourth, financial security. During this period, the U.S. economy remained in good shape, with the unemployment rate and consumer price index at low levels, and the financial system was stable.

2. Basic Methods of Financial Security Monitoring and Alerting System

As the research on financial security monitoring and early warning system has more difficulties, there is no complete and accurate research result at home and abroad, and the preliminary research results mainly include:

(1 ) Signal analysis method. This method mainly takes the mechanism of the transformation of the state of financial security as the starting point, studies the various factors affecting financial security, examines their change patterns, analyzes the factors leading to a country’s financial insecurity or financial crisis, and then formulates countermeasure strategies and measures accordingly.

Signal analysis was first introduced in 1997 and has been gradually improved to become the most important financial security alert theory in the world today. The core idea of the theory is to select a series of indicators and determine their critical values based on historical data. When the critical value of an indicator is breached at a certain point in time or over a certain period of time, it means that the indicator has sent out a crisis signal; the more crisis signals are sent out, the greater the likelihood that a crisis will break out in a certain country in the next 24 months.

Typical of approaches such as signal analysis is the development of econometric models that attempt to model the transformation of financial security states as the result of changes in a set of variables, and which are thought to find quantitative relationships between different security states and these variables. Typical models include the probit or logit models of Frankel et al. and the cross-sectional regression models of Sachs, Tornell, and Velasco. The complexity of the financial system itself and the ever-changing structure of the economy have limited the usefulness of traditional econometric models in forecasting. As far as the actual effect is concerned, these two sets of models did not give any warning of the Asian Financial Crisis that broke out in 1997. At present, the theoretical community has basically reached a consensus that the idea of using traditional econometric models to predict financial crises is ineffective. In our view, signal analysis can determine the main causes of threats to a country’s financial security after the event, thus facilitating managers to formulate corresponding countermeasures. However, since signal analysis cannot give quantitative criteria, it is difficult to predict when a crisis will occur. Moreover, market confidence plays an important role in determining the transformation process of financial security status, and the same financial event is likely to form a very different outcome in different countries due to the differences in people’s market expectations. Therefore, the usefulness of signal analysis for forecasting is very limited.

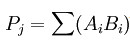

(2) Probabilistic analysis. There are two types of probabilistic methods: one is to formulate a set of indicators based on the performance of certain economic indicators under various security conditions in history without taking into account the specific factors and mechanisms contributing to the transformation of the state of financial security and to construct a comprehensive indicator to measure the overall level of risk through certain methods; the other is to use fuzzy analogies to monitor and warn of the actual economic and financial operating conditions by comparing them with historical data. The former is represented by Kaminsky. The representative of the former is Kaminsky, and the representative of the latter is Lawrence Liu. It is worth mentioning that Lawrence Lau’s fuzzy analogical approach (or subjective probability approach ) is valued for its relatively successful prediction of the Asian financial crisis. In probabilistic analysis, a series of critical values of the state of safety are usually drawn up based on a country’s historical observations or internationally recognized standards. Indicators within a certain critical range are assigned corresponding warning values, and weights are determined according to the degree of impact of each indicator on a country’s economic security. The weighted average of the warning values of all these indicators can be used to construct a composite indicator that reflects the overall security situation. Similarly, a table of critical values for the composite indicator can be derived. Based on the calculated composite indicators, we can determine the security status of a country’s financial system and calculate the probability of a crisis with the help of certain methods. One way to calculate the probability of a crisis is to use the formula:

Where Pj denotes the probability of a crisis occurring in month j, Ai denotes the alert value of the ith indicator; Bi is the weight of the indicator. The selection of appropriate indicators is the key to establishing a reliable probabilistic analysis alert system. These indicators must be able to respond quickly and accurately to various factors affecting financial security. Conventional probabilistic analysis only utilizes quantifiable indicators, so in terms of specific applications, comparisons are usually made with countries that are in a similar situation and have experienced financial security problems. In practice, this similarity of situation contains a great deal of qualitatively described information. For example, Lawrence Liu successfully predicted the Asian Financial Crisis after comparing 10 indicators ( real exchange rate, real GDP growth rate, relative inflation rate, international and domestic interest rate differentials, international and domestic interest rate differentials, real interest rate, domestic savings rate, international trade balance, current account balance, and the ratio of foreign portfolio investment to foreign direct investment ) of the Asian countries and Mexico when the crisis occurred. The Asian Financial Crisis. Probabilistic analysis can clearly point out the probability of a crisis occurring under certain circumstances, and can issue timely warning signals. However, it also has its drawbacks: it cannot directly give the reasons for the deterioration of certain indicators, making it difficult to propose strategies accordingly; and the standard of comparison is historical data, which lacks sensitivity to new problems. Nevertheless, since probabilistic analysis has certain advantages in quantitative research, it has become the most widely used method nowadays.

In order to safeguard financial security, advanced monitoring and early warning systems are needed. With the development of financial globalization and the increasing complexity of financial markets, it is not easy to sort out from the complicated financial environment the factors and their veins that have a decisive impact on the overall situation of financial operations. However, current probabilistic analysis techniques rely too much on quantitative indicators, which do not contain sufficient market information, and many of the factors that have a significant impact on financial security cannot be directly quantified, such as culture and psychological tolerance. The reason why Prof. Lawrence Liu’s prediction has achieved better results is that the stage of economic development and the degree of openness of Southeast Asian countries have more similarities with some Latin American countries, and many qualitative indicators can be replaced by references. However, it is difficult to find reference countries that are similar in all aspects when the target of the study is relatively special. For example, China’s economic system and economic structure are in the stage of transformation, so it is impossible to make effective warnings on the state of financial security by using only quantitative indicators. Therefore, it is necessary to introduce more qualitative descriptive information into the system of financial security monitoring and warning indicators.

Issues of Financial Security in China

At present, the situation of financial security in China is still not optimistic, mainly in the following aspects:

1. The negative impact of illegal capital flows on the financial security of the country.

Openness to the outside world has facilitated the development of China’s economic and financial internationalization, and the increase in the degree of external dependence indicates that the level of China’s utilization of international resources and the international market has greatly improved, and that China’s ability to participate in the international division of labor and international competition has been further strengthened, which has played an extremely important role in raising the overall level of China’s national economy.

However, as a developing country, in the process of opening up to the outside world, there are many factors that have caused serious negative impacts on the financial security of our country, and an important manifestation of these factors is the illegal inflow and outflow of capital. This has adversely affected the normal financial order of China, increased the difficulty of macro-financial regulation and control, reduced the effectiveness of monetary policy, and easily caused financial bubbles and increased financial risks.

2. The risks posed by economic globalization to China’s financial security.

Under the trend of economic globalization, the outdated operation mode of traditional financial enterprises in China is obviously at a disadvantage in the competition with advanced financial operation modes abroad, and it is difficult for the existing macroeconomic regulation and control tools to meet the requirements of integrated economic development. Therefore, the opening up of China’s economy and finance to the outside world is a complex systematic project, which should be carried out in a gradual and orderly manner on the basis of vigorously improving the domestic macroeconomic and financial regulation and control capabilities.

3. Challenges to China’s financial security as a result of its accession to the World Trade Organization.

It is important to fully recognize the pressure and impact that the opening up of the financial market will have on China’s financial industry.

- First, the state-owned commercial banking system, which has yet to be fully corporatized, is unable to compete with large and powerful banks in developed countries in terms of service quality, work efficiency, operational capacity, and technological conditions, despite its large number of branches. Once foreign banks are allowed to enter the market in large quantities and the restrictions on Renminbi (RMB) business are lifted, the four major state-owned commercial banks will face a serious problem of loss of some of their high-quality customers.

- Second, under the conditions of financial liberalization, the market interest rate will inevitably replace the official interest rate, and the existing non-market-based exchange rate determination mechanism will be put to the test.

- Third, with the continuous liberalization of the money market, capital market and foreign exchange market, the free flow of capital will bring a lot of difficulties to China’s economy, financial macro-control and financial supervision, and the flow of large amounts of short-term capital in and out of the country will pose a great threat to China’s financial security.

4. The impact of capital account liberalization on China’s financial security.

After joining the World Trade Organization, China’s requirements on capital transfer limits will be relaxed, the control of foreign exchange receipts and expenditures of foreign enterprises belonging to capital items will be loosened, and the control of the amount of foreign exchange assets held by residents abroad will also be loosened, which will undoubtedly increase the difficulty of managing the capital account: once a large amount of long-term capital inflow occurs, the rapid increase of resources can’t be efficiently configured and utilized, plus the increase of banking system liquidity will stimulate the excessive increase of financial asset prices, which will in turn lead to the vulnerability of the whole financial system, or even collapse. This, coupled with the increase in liquidity in the banking system, will stimulate excessive increases in financial asset prices, which in turn will lead to economic bubbles and ultimately to the weakening or even collapse of the entire financial system.

5. The impact of international hot money on China’s financial security.

According to the estimates of the International Monetary Fund (IMF), the daily volume of international financial asset transactions is about 80 times the volume of trade transactions. At present, short-term capital of a lobbying nature has exceeded US$10 trillion, and US$1 trillion of lobbying capital seeks a home in the global capital market every day. In our country, since financial laws and regulations are not yet sound, and the security supervision capacity is not yet sufficient to cope with external risks, once a large amount of international liquidity impacts our financial market, it is bound to cause chaos in the financial order and trigger a financial panic.

6. Internet finance raises new issues for China’s financial security.

With the rapid development of global computer technology, online banking and finance have become a reality. On the Internet, banks and customers can complete their daily business transactions without having to meet in person, which eliminates time and geographical differences, changes the traditional mode of financial business operation, and improves service quality and efficiency. At the same time, however, it should also be noted that as an open Internet, its security is increasingly threatened by various aspects. In recent years, the online banking systems of many countries in the world have been attacked to varying degrees, and these facts clearly tell us that the more high-tech technology exists, the more there is the hidden worry of being disturbed or even paralyzed.

The Internet banking business in China is in its infancy, and the risk prevention measures are not yet perfect. Many important banking systems, such as the online banking payment system, credit card system, and clearing system, are at risk of being attacked and damaged by uninvited guests at any time. We have introduced advanced online financial technology, but the supporting risk prevention system and security alert system need to be gradually integrated with China’s national conditions, and in the meantime, the issue of financial security is particularly important.

7. The backwardness of financial equipment and the low degree of nationalization are major hidden dangers to China’s financial security.

- First, most of the platforms used by banks in China for financial e-business are imported from abroad and are fundamentally unsafe. We may focus too much on the benefits and convenience of e-business, but it is easy to overlook the fact that most of the e-business platforms we use are imported from overseas. Since the software of these platforms does not disclose the source code, there is no way to know the strength of their risk prevention capability.

- Second, most of the core technology of financial electronic equipment in China is imported from abroad, making the foundation of financial security extremely fragile. In the process of developing financial electronics in China, the idea of “exchanging market for technology” was put forward, just as in the process of introducing equipment in other industries. However, in the process of financial electronics, the dependence on foreign technology has been increasing, whether it is the operating platform within the entire financial system or core technologies such as electronic payment systems. As a result, the foundation of China’s financial security is extremely fragile. The reason for this consequence is that in the process of introducing financial equipment, it has always been the introduction of consumer behavior, usually directly by major banks and financial institutions, so they are concerned about consumer technology rather than research and development and equipment technology. As a result, we have not been able to support our own financial equipment research, development and production forces in the same way as the automobile manufacturing industry and other industries.

8. Financial supervision is not yet fully adapted to the needs of China’s financial security.

Judging from the actual situation of China’s economic and financial internationalization, the capacity of China’s financial supervision is not yet fully able to meet the needs of external opening. There is still a gap between the organization of financial supervision, human resources and technical means and the requirements of modern financial supervision. The financial supervisory system and level of supervision are not yet fully adapted to the needs of China’s financial security.

9. The construction of the financial legal system is not fully compatible with the requirements for safeguarding China’s financial security.

Financial laws and regulations are the legal basis for the implementation of financial supervision and the protection of financial security in China, and are also the fundamental guarantee for the standardization and legalization of financial supervision. In recent years, China has promulgated a series of financial laws, such as the Law of the People’s Bank of China, the Commercial Bank Law, the Insurance Law, and the Securities Law, which have played a positive role in practice. However, China’s financial legislation is still a very difficult task, and certain aspects of the legislation are obviously lagging behind, which is not yet in line with China’s financial reform and the requirements for safeguarding financial security. From the financial practices of various countries, with the global financial liberalization, internationalization, integration as the characteristics of the continuous development of financial change, countries in the financial legislation, in particular, pay more attention to control, supervision and grasp of the scale.

In the course of development, some emerging countries in Asia have failed to realize the importance of effective supervision based on the liberalization of interest rates and opening up of domestic financial markets through legal means and forces, thus the entire national economy lacks the necessary ” firewall ” and serious deficiencies in the financial legal system, especially in the regulatory laws and regulations, which were fully exposed when they were hit by the shock and became a source of concern for the international financial community. These deficiencies were fully exposed when the country was hit, and became the mechanism that led to the entire financial crisis. In the course of its development, China must face this problem squarely and vigorously strengthen its financial legislation in order to realize effective financial supervision, circumvent institutional risks and safeguard financial security.

Research on Financial Security Issues in China

In view of the current problems in the area of financial security in China and the lessons learned from international experience, it is important for us to study the financial security issues ahead of time in order to avoid harm.

(a) Setting up a specialized financial security research and decision-making organization to formulate financial security policies and standards. Since financial security is related to China’s economic security and even national security, the State should attach great importance to the protection of financial security. After thorough research and analysis of the domestic and foreign markets and the local and foreign currency markets, practical financial risk prevention measures and financial security policies should be formulated, and their implementation should be measured by international standards. Only in this way can China’s financial security work be carried out smoothly.

(b) Increase investment in research and development of financial electronic software platform and core technology of financial electronic equipment, raise the level of domestication of financial equipment, and strengthen the foundation of financial security. Focusing on the current situation that China relies entirely on foreign imports for its financial electronic software platform and core technologies of financial electronic equipment, China should, in the process of focusing on financial security, vigorously increase its investment in this area, and through fostering its own technological strength and production capacity, raise the level of domestication of financial equipment, especially core equipment, so as to truly consolidate the foundation of China’s financial security.

(c) Strengthening the legal framework for financial security, raising the level of supervision by financial regulators, and eliminating potential financial security risks in a timely manner. The Southeast Asian financial crisis has taught us a profound lesson: although the financial crisis was caused by external currency speculation, it was fundamentally a crisis of its own origin. It is a combination of a currency crisis, a banking crisis, a debt crisis, and a solvency crisis. The backwardness of the legal system for financial security is the root cause of this financial crisis.

Therefore, in the development of economic globalization, China should strengthen the construction of financial legal system, improve and perfect the financial legal system, and gradually form an environment of financial standardization and legalization in which laws must be complied with, violations must be investigated, and law enforcement must be strict, so as to change as soon as possible the phenomenon that the important laws and regulations of the financial market are incomplete, and that there is no way to comply with certain important financial activities, and at the same time, it should strengthen the study of the operability of laws and regulations. It is also necessary to rationalize the legal relationship between the government, enterprises and banks, and to speed up the reform of the administrative system and the reform of the banking management system. Enforcement of financial laws should be strengthened.

Firmly enforcing the systems of market entry, business qualification and separate business operation. The national financial regulator should be given the powers it deserves and be made operationally independent. The financial law enforcement team must be enriched and the quality of financial law enforcement officials must be improved. Financial crimes and illegal and irregular activities should be severely punished, and strong measures should be taken to firmly curb the rising trend of major and important cases.

China should accelerate the establishment and improvement of the financial supervision system under the conditions of market economy, and strengthen financial supervision by taking reference from the Basel Agreement: in terms of supervision targets, change from focusing on the supervision of banking institutions to the supervision of all financial institutions; in terms of supervision scope, change from targeted supervision to all-around supervision; in terms of supervision methods, change from stage-by-stage supervision to continuous supervision, and from general administrative supervision to legal supervision; in terms of supervision means, change from focusing on external supervision to focusing on the internal control of financial institutions; and in terms of supervision information, change from focusing on on-site inspection to focusing on off-site inspection. In terms of supervisory approach, it has changed from stage-by-stage supervision to continuous supervision, from general administrative supervision to supervision in accordance with the law, and from external supervision to internal control of financial institutions; in terms of supervisory methods, it has changed from on-site inspection to off-site inspection; in terms of supervisory information, it has changed from emphasis on the timeliness of the reporting figures to the truthfulness of the reporting figures; and in terms of supervisory content, it has changed from emphasis on compliance supervision to emphasis on risk supervision.

(d) Continuously deepen financial reforms and establish an orderly pattern of financial openness that suits our national conditions, so as to adapt to the world trend of economic globalization and financial liberalization. At the same time, it will ensure that financial security and national interests will not be jeopardized. Economic globalization is a global trend. For our country, on the one hand, we should not give up the opportunity and right to participate in the process of globalization, and actively participate in the establishment of the international financial system and the new world economic order to promote its own development; on the other hand, we should attach great importance to the negative impacts of economic globalization, and strengthen our ability to prevent and defend against risks. To this end, we must further deepen the reform of the financial system, intensify the reform efforts, and gradually establish a pattern of external liberalization that suits the national conditions, and establish a new type of financial system that adapts to the socialist market economy system. It is necessary to improve the means of macro-regulation and coordination mechanism, establish and improve the multi-level financial risk prevention system, and strengthen the control of financial risks. Through the continuous deepening of financial reforms, China will be able to adapt to new international rules in the process of financial liberalization as soon as possible, and at the same time effectively reduce the economic losses caused by financial risks.

Pingback: 2024 CPPCC paper: Promoting PRC Financial Opening | 高大伟 David Cowhig's Translation Blog